Yondr Group Leads Asia’s Record $4.7B Data Center Surge with $900M AI-Ready Campus in Malaysia

At a press event in Singapore on Oct. 10, 2024, Singtel launched its new AI cloud service. From left: Bill Chang, CEO, Digital InfraCo; Gan Kim Yong, deputy prime minister of Singapore; and Yuen Kuan Moon, group CEO, Singtel.

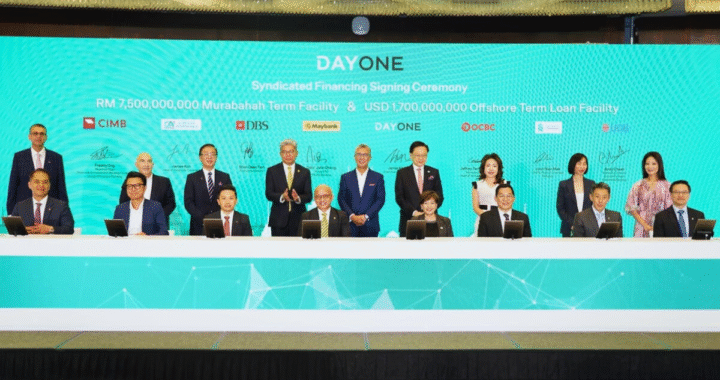

Yondr Group has emerged as a major player in the Asia-Pacific’s booming data infrastructure market, recently delivering the first 25 megawatts of IT capacity at its massive 300MW hyperscale campus in Johor, Malaysia, six months ahead of schedule. Financed through a $900 million consortium including DBS Bank, Deutsche Bank, and BlackRock’s Global Infrastructure Partners, the project underscores a broader wave of record capital flowing into the region’s data center builds.

The $4.7 billion investment in Asia-Pacific data center infrastructure this year marks a historic high, driven by soaring demand for AI and cloud services. Yondr’s Johor campus, one of the region’s largest, employs advanced direct-to-chip cooling technology and a sustainable design, reflecting the increasing importance of environmental responsibility alongside scale.

“We’re pioneering AI-ready infrastructure in the region,” said Mark Avery, Yondr’s senior vice president for design and construction in the Asia-Pacific. “Delivering six months early demonstrates the urgency and precision required to meet today’s AI workloads.”

The rapid pace is notable in an industry often plagued by construction delays, where postponements can escalate costs and slow enterprise adoption of AI solutions. For businesses still relying on legacy data centers, experts warn that retrofitting to meet AI’s power and cooling demands could prove far more expensive and inefficient than investing in purpose-built facilities today.

Investment Surges Amid Looming Power and Capacity Constraints

The region’s data center market growth is propelled by rising cloud adoption and a surge in AI applications, especially in industries such as finance, healthcare, and manufacturing. Yet analysts caution that the Asia-Pacific region faces a looming supply shortage, with power constraints and a lack of AI-specific infrastructure threatening to create a gap of 15 to 25 gigawatts by 2028, according to a recent CBRE report.

Alongside hyperscale operators like Yondr, telecom giants are also moving aggressively to capture AI infrastructure demand. Singapore-based Singtel launched its AI cloud service last fall, powered by Nvidia GPUs and tailored to sectors with strict data residency needs, highlighting growing enterprise demand for localized, high-performance computing options.

“The market window to deliver AI performance locally is wide open,” said Manoj Prasanna Kumar, CTO of Singtel Digital InfraCo. Singtel’s multi-cloud orchestration platform aims to offer flexible, hybrid cloud environments, further evidence of how competition is intensifying in the region.

While investment flows reach record highs, energy availability remains a critical bottleneck. CBRE’s analysis stresses that overcoming power delivery and efficiency challenges will be key to closing Asia’s data center supply gap. Sustainable technologies like those used at Yondr’s Johor campus are expected to play an increasingly central role in future developments.

As capital pours into the region’s hyperscale projects, the stakes are high. For operators and investors alike, the cost of hesitation is growing. Those who delay upgrading or building AI-ready infrastructure risk being left behind in an accelerating digital economy.

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot  Redefining the Grid – Why the Power System Is the New Data Center Frontier

Redefining the Grid – Why the Power System Is the New Data Center Frontier  Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability

Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability  Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration

Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration  Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind

Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind  The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom

The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom