Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability

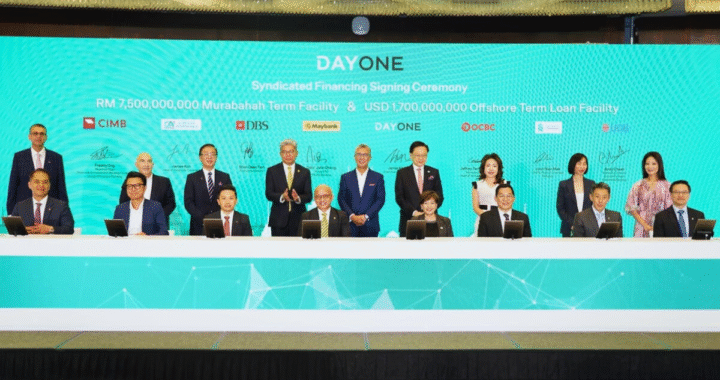

Financial leaders from Maybank, OCBC, DBS, UOB, CIMB, Crédit Agricole, and Standard Chartered supporting DayOne Data Centers’ record green financing for projects in the Johor-Singapore Special Economic Zone.

There is no shortage of capital chasing digital infrastructure. But a growing number of deals are running into new roadblocks: execution risk.

The most illustrative case is DayOne Data Centers’ RM15 billion Islamic green financing deal, signed in early 2025. It was Southeast Asia’s largest financing package for a data center platform, underwritten by a syndicate of regional and international banks including Maybank, OCBC, DBS, and Crédit Agricole. The landmark deal supports hyperscale campuses in the Johor-Singapore Special Economic Zone, where power, permitting, and cross-border coordination are being closely watched.

Underwriting Shifts From Rent Rolls to Real Delivery

Unlike past deals, where lease rates and absorption drove lender appetite, this structure required deep technical due diligence. Lenders scrutinized power purchase agreements, construction timelines, and regulatory approvals. Execution risk – not capital scarcity – is now the key variable in underwriting.

This trend is becoming visible in other major projects. In April 2025, STT GDC’s expansion in Vietnam faced possible delays when grid interconnection timelines became uncertain. Meanwhile, in India, new regulatory guidelines on power-intensive development are prompting banks to revisit risk premiums for hyperscale projects in Chennai and Hyderabad.

The market is adjusting. Major funds like Brookfield and GIC are deploying internal teams to vet utility access, construction phasing, and local policy environments before term sheets are issued.

The New Investment Equation

As AI-ready builds escalate to $10–12 million per megawatt, investors and operators must align early on project viability. Financial close depends on more than spreadsheets. It requires confidence in permitting, power access, water availability, and multi-year delivery capability.

Institutional capital is abundant, but it’s becoming more selective. The question is no longer whether a site can attract tenants. It is whether it can be built and operated within regulatory and infrastructure constraints. For data center CEOs and dealmakers, that means deeper coordination with engineering, legal, and energy advisors well before capital is deployed. The old model – build, lease, collect – is no longer sufficient.

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot  Redefining the Grid – Why the Power System Is the New Data Center Frontier

Redefining the Grid – Why the Power System Is the New Data Center Frontier  Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration

Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration  Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind

Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind  The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom

The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom  SoftBank Bets on Green Future with Japan’s Largest AI Data Center in Hokkaido

SoftBank Bets on Green Future with Japan’s Largest AI Data Center in Hokkaido  Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability

Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability