A Filipino business owner pays 2 times what their Chinese competitor pays per kilowatt-hour.

Filipinos pay the most per kilowatt-hour of electricity compared to neighboring FDI destinations like Malaysia, Indonesia, Bangladesh, Thailand, Vietnam, and India. An average Filipino consumer pays US$ 0.18 per kWh, twice the US$ 0.08 per kWh paid by their counterpart in China and almost 4 times the US$ 0.05 per kWh paid by their Malaysian counterpart.

To address this imbalance, CEOs in the Philippines’ power sector are working closely with the government to reduce the high cost of electricity for households and businesses.

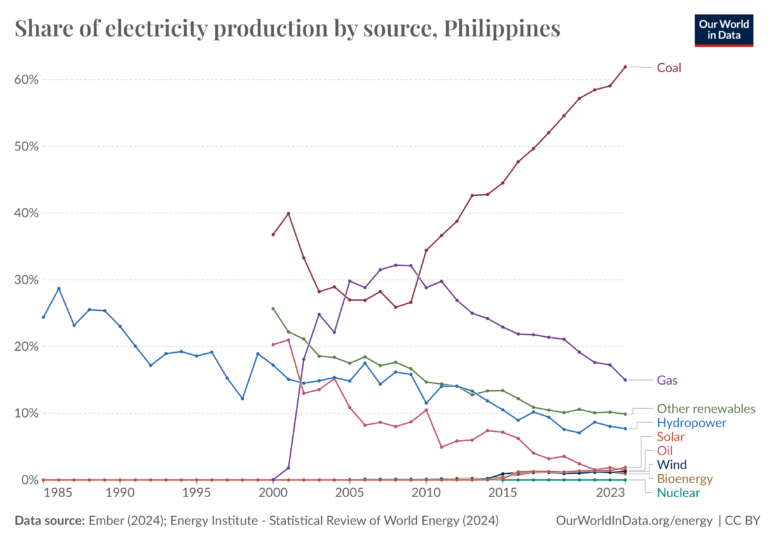

Despite all these efforts, the country remains dependent on costly imported fossil fuels like coal for its power generation. In 2022, the Philippines imported US$ 5.18 billion in Coal Briquettes, becoming the 11th largest importer of Coal Briquettes in the world. In that period, Coal Briquettes were the 3rd most imported product in the Philippines.

The country needs to diversify its energy mix, if it wants to keep up its 6.2% GDP growth rate.

This is especially true for baseload, where coal remains the overwhelming choice because of the intermittent output from renewable sources. Despite the seemingly aggressive drive to promote clean energy everywhere, coal power plants still comprise 43.9 percent of the Philippines’ on-grid installed capacity as of 2023, contributing 12,406 MW.

And the business costs are steep. Hoping to increase its manufacturing capacity and presence in Asia, Intel opened its manufacturing facility in the Philippines in 1974. It had only been two years since they opened their first facility outside the United States in Penang, Malaysia, and they hoped to benefit from cost efficiencies from the country’s labor market and operating environment.

Imagine the disappointment in 2009 when 1,800 workers at the company’s Philippine facility heard that they were going to lose their jobs because of high energy costs.

Now, 15 years later, the Philippines still has not managed to win Intel back to the country. Meanwhile, the company’s facility in Penang has burgeoned from its original 100-strong workforce to approximately 15,000 professionals. Within the next 10 years, the company plans to increase its cumulative investment in Malaysia from the current US$ 7 billion to over US$ 13 billion.

That’s a lot of jobs supporting a lot of households and a lot of local suppliers that disappeared due to the Philippines’ high electricity costs.

Nuclear technology offers a path forward.

One uranium fuel pellet holds as much energy as one ton of coal, 149 gallons of oil, or 17,000 cubic feet of natural gas.

If the Philippines’ government and power sector can work together to lower electricity costs and break their dependency on coal:

- More companies will be able to tap the country’s 49.5 million-strong workforce with a median age of 25.7 years.

- Local manufacturers can finally compete in energy-intensive activities like fractional distillation, cracking, iron processing, steelmaking, and cement production.

- The Philippine economy can capture more of the foreign investment now rushing to China’s other neighbors as MNCs derisk their supply chains using the China Plus One strategy.

- The average Filipino household can finally afford to enjoy modern conveniences like air conditioning, hot showers, and making lechón in a slow cooker.

- The Filipino people can finally reach high-income status by 2045 as projected in the Philippine Development Plan, creating a consumer market the size of Canada’s today.

What wouldn’t you give to be part of the greatest economic comeback the world has ever seen?

Secure your spot today and join us at Nuclear Power Forum Asia 2024 this November 20-22, 2024, in Manila, Philippines!

It’s EASY to REGISTER TODAY!

- Finance Your Initial Capital Costs: Find partners to help you cover the upfront investment to develop, build, and commission your first nuclear power facility.

- Establish Regulatory Frameworks: Get help with regulatory approvals to speed up project timelines and control costs.

- Gain Public Support and Acceptance: Understand proven strategies to constructively address local stakeholders' concerns about safety, environmental impact, and radioactive waste management.

- Secure Funding for Your Projects: Protect your project's financial health throughout the entire duration from FID to ROI.

- Build Your Team's Technical Capacity: Discover education and training programs, scholarships, and other support available for you to develop the local expertise and skilled workforce you need to design, build, and operate your first nuclear power plant.

- Develop Your Supply Chains: Build a resilient supply chain for your proof-of-concept nuclear power project.

- Ensure Transmission and Offtake: Secure grid access and early-adopter qualified electricity users to create a revenue floor for your project.

- Set Up International Collaborations: Align with global regulators and regional peers to get help with NPT compliance.

Register today to secure your place in the conversation.

A limited number of complimentary passes to this year’s forum have been reserved for:

- HAPUA members' CEOs and senior management (CXO) considering nuclear power for their generation fleets

- RCOA-eligible Contestable Customers: Philippine establishments and companies with an average peak demand of at least 500kW or with an average billing of PHP 950,000 in the past 12 months (proof of average peak demand, average billing, or RCOA registration required)

- Governors, Vice Governors, Provincial Board Members, Mayors, Vice Mayors, and Councilors from the Philippines that would like to host nuclear power facilities in their respective Local Government Units (proof of support will be verified, such as from past media statements, etc.)

Email Mia Messina today to get your special pass.

The draft Philippine Nuclear Energy Program (PNEP) 2024-2050 outlines the targets for the country’s successful commercial operation of nuclear power plants.

The target minimum nuclear power capacity is 1,200 megawatts by 2032, 2,400MW by 2035, and 4,800MW by 2050. At US$ 9 million per MW, this translates to:

- By 2032: 1,200 MW = up to US$ 10.8 billion

- By 2035: 2,400 MW = up to US$ 21.6 billion

- By 2050: 4,800 MW = up to US$ 43.2 billion

Email Mia Messina today to receive sponsorship information.

Supporting the Energy Transition to Net Zero

Past Nuclear Power Forum participants include

Speakers and Moderators from

Join the Site Tour!

Philippine Nuclear Power Plant 1 (PNPP-1)

Did you know?

A Filipino breadwinner needs to work as much as 2 days, 7 hours, 41 minutes, and 5 seconds to afford just 1 hour of air conditioning from a 1500W inverter unit.

▸ See our comparison of Asian FDI destinations in the brochure

Comparison of electricity costs across popular FDI destinations in Asia. Duration to work to afford 1 hour of air conditioning is calculated from cost per kWh, GNI per capita, annual working hours per worker, labor force participation rate, and youth dependency ratio.

The Philippines has become heavily reliant on costly imported coal for its power generation. In 2022, the Philippines imported US$ 5.18 billion in Coal Briquettes and was the 11th largest importer of Coal Briquettes in the world. In 2023, coal power comprised 61.92% of the country’s electricity mix.

Supporting the Energy Transition to Net Zero

Past Nuclear Power Forum participants include

Meralco, the Philippines’ largest electric distribution utility, signed a cooperative agreement with Ultra Safe Nuclear Corporation (USNC) on November 15, 2023, on the sidelines of the 30th APEC Leaders’ Summit, to study the potential deployment of one or more MMR Energy Systems in the Philippines.

Raise your profile

- Build awareness and front-of-mind branding that delegates can bring back with them to their respective worksites

- Re-establish valuable relationships with decision-makers in the industry

- Reinforce the business case for your solutions by showcasing technical and financial capabilities

Get in touch today to customize your participation.

Advertisement for Nuclear Power Forum Philippines 2010

Register today

Nuclear Power Forum Asia 2024

Affordable, Reliable, and Clean Energy to Reduce Business Costs and Sustain High GDP Growth

November 20-22, 2024

Manila, Philippines

+63 2 8785 1977

[email protected]

Affordable, Reliable, and Clean Energy to Reduce Business Costs and Sustain High GDP Growth

November 20-22, 2024

Manila, Philippines

+63 2 8785 1977

[email protected]

Speakers and Moderators from

Past Nuclear Power Forum Participants include

© 2024 Arc Media Global. All rights reserved.