Power Crunch Looms Over Asia-Pacific’s $4.7B Data Center Boom: Urgent Need for Grid Innovation

CBRE’s Asia Pacific Data Centre Trends & Opportunities 2025 report, citing McKinsey, warns of persistent shortfalls. Even if data center supply in the region doubles over three years, a 15–25 GW shortage is projected to remain by 2028.

The Asia-Pacific region’s rapid surge in artificial intelligence and cloud adoption is fueling an unprecedented boom in data center construction. Yet a severe power delivery gap threatens to stall that growth, with forecasts projecting a shortfall of 15 to 25 gigawatts by 2028 – enough to power millions of homes.

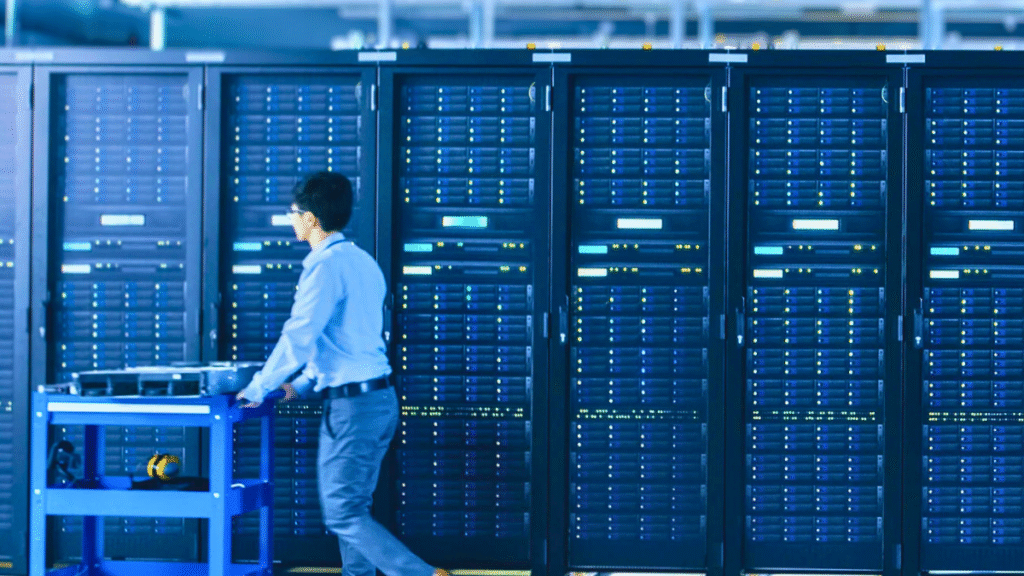

The region’s data center power supply is expected to double within the next three years, according to industry research. Still, legacy infrastructure isn’t keeping pace with AI’s steep power and cooling needs. AI-optimized compute racks consume more than twice the power density of traditional data centers and require specialized cooling and structural enhancements largely absent from existing facilities.

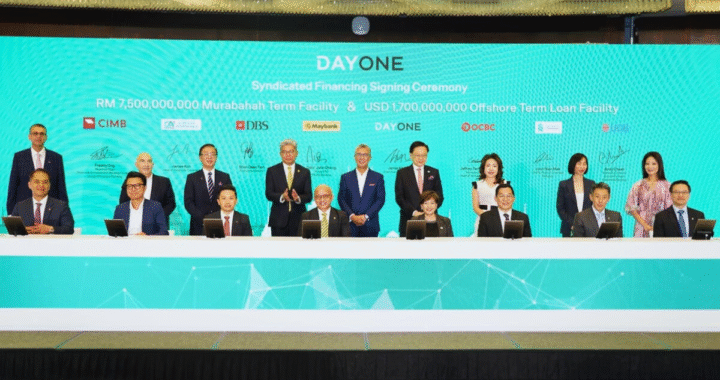

Despite a record $4.7 billion in direct investment flowing into Asia-Pacific data center projects last year, the looming power crunch poses a growing risk to operators and investors alike.

Power Constraints Could Dim Asia’s AI Ambitions

A recent CBRE report warns that the Asia-Pacific’s power deficit threatens to choke the expansion of AI-ready data halls just as demand for these facilities skyrockets. Many data centers were designed before AI workloads drove up power density and cooling requirements, creating a mismatch that experts warn will lead to unplanned outages, equipment failures, and operational disruptions.

“Securing scalable, high-efficiency energy delivery is no longer optional,” said Tom Fillmore, Executive Director for Data Centers at CBRE Asia Pacific. “Operators and investors who delay upgrading power infrastructure risk falling behind in the AI infrastructure race.”

Sustainability is also reshaping the data center landscape. Leading operators like Yondr Group, which recently fast-tracked the delivery of a 25-megawatt AI-ready facility in Malaysia, are turning to advanced cooling technologies and renewable energy sources to manage soaring energy consumption while mitigating environmental impact.

Geographic constraints add urgency to the issue. Singapore’s limited land and power availability have pushed many operators to expand in neighboring Malaysia and Thailand. Regulatory reforms, such as Vietnam’s easing of foreign ownership caps, are further opening new markets for infrastructure investment.

With AI workloads expected to double power density requirements over the next five years, the Asia-Pacific’s data center sector stands at a crossroads. The cost of inaction could mean not only lost revenue and operational risks but also a diminished role for the region in the global AI economy.

For industry players, the message is clear: prioritize power infrastructure upgrades, embrace green innovation, and diversify markets strategically – before the lights go out on Asia’s data center boom.

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot

Time to Market – Why Execution, Not Strategy, Is the Philippines’ Digital Pivot  Redefining the Grid – Why the Power System Is the New Data Center Frontier

Redefining the Grid – Why the Power System Is the New Data Center Frontier  Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability

Deal Architecture 2.0 – Execution Risk Outpacing Pure Capital Availability  Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration

Cross-Border Complexity – How Hyperscale Is Forcing Horizontal Integration  Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind

Energy, Not Just Real Estate – Rethinking Data Campuses With Power in Mind  The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom

The Real Bottleneck: Why Energy, Not Ambition, Is Stalling the Asia-Pacific’s AI Data Center Boom