Sizzling Valuations No Bar for Deals as AI Boom Beckons

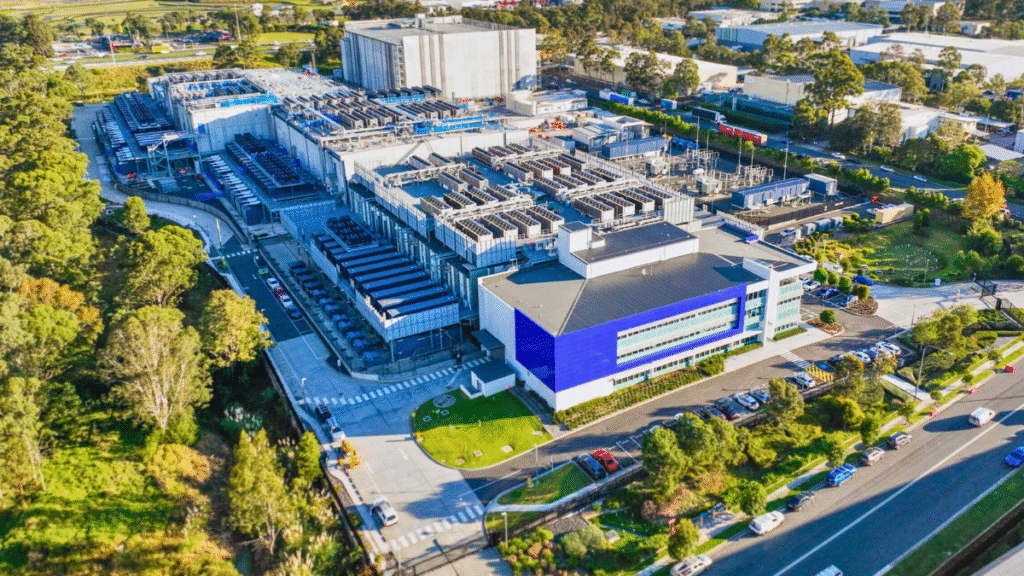

A September deal led by Blackstone set a benchmark when it agreed to acquire Australian operator AirTrunk for an implied enterprise value north of A$24 billion ($15.6 billion), or more than 20 times forward core earnings.

Investors remain undeterred by sky-high valuations as they pour into Asia-Pacific data centers, drawn by surging demand for artificial intelligence services. Industry insiders say rich price tags reflect the sector’s nascent growth outlook, even as concerns over infrastructure shortfalls linger.

Blackstone’s A$24 Billion Valuation Benchmark

A September deal led by Blackstone set a benchmark when it agreed to acquire Australian operator AirTrunk for an implied enterprise value north of A$24 billion ($15.6 billion), or more than 20 times forward core earnings. Since then, interest has rippled through the region’s operators.

In Indonesia, the state-owned Telkom Group launched a process in October to sell a 20 percent to 30 percent stake in its data center arm. Sources familiar with the matter say parties, including Singapore Telecommunications Ltd. and BDx Data Centers, have expressed interest. At an implied valuation above $1 billion, the deal underscores the appetite for assets that plan to ramp capacity from roughly 60 megawatts today to 500 megawatts by 2028–30.

“Valuations of data center assets mirror the rapid growth fueled by hyperscale orders,” said Manjit Balgir, head of Asia telecom and digital infrastructure at Bank of America Merrill Lynch. Brokerage BRI Danareksa Sekuritas analyst Niko Margaronis added that Indonesian data center NeutraDC could command more than 20 times core earnings.

Even small-stake offerings are drawing deep pockets. Australian alternative asset manager HMC Capital’s initial public offering of its DigiCo REIT raised A$1.995 billion, offering 399 million securities to fund an initial portfolio of 13 data centers. Shares opened at A$4.98, climbed to A$5.10, and settled near A$5, giving the trust a market capitalization of about A$2.75 billion and a gearing ratio of 35.1 percent.

Execution Risks and Future Outlook

Execution risks, however, remain front of mind. In many urban centers, power constraints and soaring land costs have driven developers to secondary markets that lack reliable fiber and electricity. A shortage of skilled technicians, projected to leave Asia more than 4 million IT staff short by 2030, could strain build-out timelines.

“Getting capacity online reliably will be crucial for tenants,” said Gilles Chow, managing director and head of real estate for North Asia at CPP Investments. He and other investors warn that the premium multiples now on offer will only hold if operators deliver on ambitious expansion plans.

Despite those concerns, deal makers have been undaunted. KKR paid S$1.1 billion ($818 million) for a 20 percent stake in Singtel’s data center unit in 2023 and last year joined Singtel in a S$1.75 billion investment in ST Telemedia Global Data Centres. Deal value in the region reached $17 billion through mid-November last year, accounting for more than half of global data center M&A for 2024, according to LSEG data.

Looking ahead, some anticipate the sector’s heady growth may temper as capacity comes online. “Asia-Pacific data center markets remain a positive story in the medium term,” said Charlie Wilson, Asia M&A and private equity head at Sidley Austin. “But we expect growth to cool as new supply hits the market.”

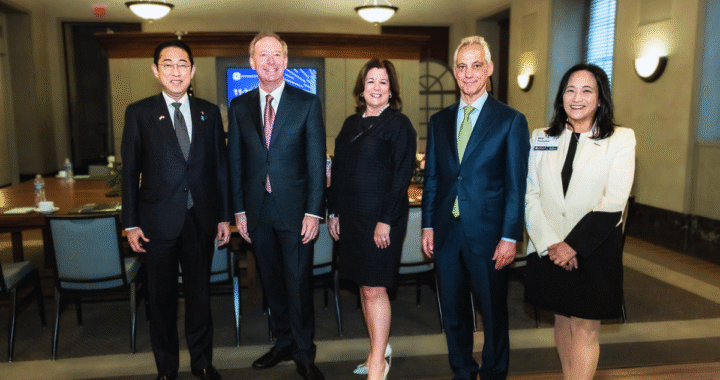

Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure

Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure  Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia

Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia  Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse

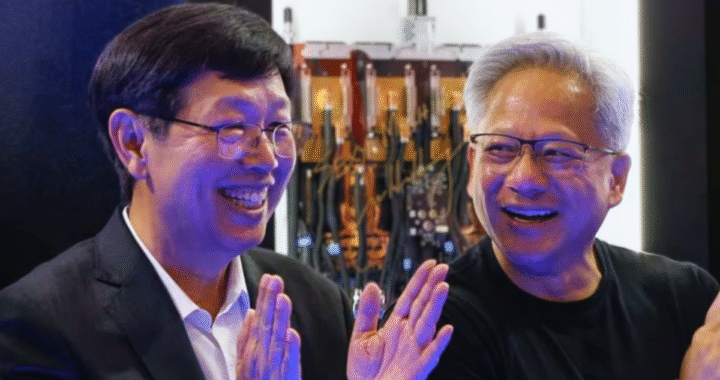

Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse  Taiwan’s Foxconn Says AI Data Center with NVIDIA to Have 100 MW of Power

Taiwan’s Foxconn Says AI Data Center with NVIDIA to Have 100 MW of Power  BDx Locks in Financing for Hong Kong Hyperscale Build-Out

BDx Locks in Financing for Hong Kong Hyperscale Build-Out  The Dynamics Shaping Success in Key Asia-Pacific Data Center Markets

The Dynamics Shaping Success in Key Asia-Pacific Data Center Markets  Sizzling Valuations No Bar for Deals as AI Boom Beckons

Sizzling Valuations No Bar for Deals as AI Boom Beckons