The Case for Mexican Production Optimization

THE OLMECA REFINERY LAUNCH IN LIGHT OF MEXICO’S ENERGY SECURITY OBJECTIVES

The July 1, 2022 inauguration of 340,000 barrels per day Olmeca refinery in Dos Bocas represents AMLO government’s objective to get energy self-sufficiency next year (2023).

To date, Mexico is a net importer of natural gas, and most imports arrive by pipeline from the United States. In 2019, Mexico imported an average of 5.5 billion cubic feet per day (Bcf/d) of natural gas from the United States (including by truck, by pipeline, and as LNG), an increase of more than 176% from 2014.

Mexico is more dependent on natural gas than ever, including to generate more than half of the country’s electricity supply, whose domestic natural gas demand has grown 30 percent to more than 9 billion cubic feet per day (Bcf/d) in the last three years.

To meet this demand, it is currently importing record amounts – roughly 5.65 billion cubic feet/day (bcf/d) via pipelines, according to data from Natural Gas Intelligence.

Mexico consumes 2,052,607 barrels per day (B/d) of oil as of the year 2016. Mexico ranks 11th in the world for oil consumption, accounting for about 2.1% of the world’s total consumption of 97,103,871 barrels per day.

PEMEX needs to raise production by 200,000-400,000 b/d before 2023 to meet Mexico’s energy security needs.

MASSIVE PRICE FOR OLMECA REFINERY, REQUIRING $6.5 BILLION MORE IN FUNDING AND EXCEEDING PRODUCTION TIMETABLE

The 340,000 b/d Olmeca refinery in Dos Bocas has been inaugurated on Friday, 1 July 2022, exactly four years after López Obrador won the presidency.

This was Mexican President Andrés Manuel López Obrador’s campaign promise of a refinery for his home state of Tabasco.

The refinery was delivered with a massive price. López Obrador said cost overruns could be in the range of 20-30% over the budgeted $8 billion. Other estimates put the total cost at closer to $16 billion.

By comparison, Mexico’s state oil giant Petróleos Mexicanos (Pemex) last year paid $596 million for Shell plc’s 50.005% stake in the 340,000 b/d Deer Park refinery in Texas.

The project is also going to end up taking longer than planned. The refinery will enter a six-month testing phase in July. Energy Ministry Sener has said the facility would then ramp up to about 240,000 b/d next year, and wouldn’t hit full capacity for another few years.

SIGNATURE REFINERY BESET BY HIGHER CONSTRUCTION COSTS, ENVIRONMENTAL AND LABOR DISPUTES

Pemex will operate the refinery, Mexico’s eighth–considered by Mexican President Andres Manuel Lopez Obrador as a signature project to help the country cut a longstanding dependence on gasoline and diesel imports and is beset by higher construction

Mexico’s state-oil company Pemex requested the week of 12 August 2022 almost $6.5 billion in additional funding from the government to pay for works at the ‘Dos Bocas’ refinery this year, according to a document and two sources familiar with the matter–$5.6 billion to continue the works and $853 million for costs associated with the start-up.

The additional funding is to cover works not initially included in the project’s proposal, higher construction and startup costs, according to the document and sources.

The additional funding would take the refinery’s price tag to $14.6 billion, the documents and the sources said, far above the original budget of $8.9 billion.

Petroleos Mexicanos’ (Pemex) board approved – by a majority but not unanimous vote – to request $5.6 billion from the government to continue the works, as well as $853 million for costs associated with the start-up of the Olmeca refinery, commonly known as Dos Bocas after the area where it is being built.

During construction, the project was also plagued by environmental and labor disputes.

EXTERNAL CHALLENGES FACED BY THE MEXICAN ENERGY SECTOR

Analysis of the energy sector as a whole and it’s possible trajectory over the next 20 years suggests that Mexico is shifting from a position of energy independence to one of dependence on primary energy, although petroleum will continue to be the most important energy source for the next 25 years and the prime object of strategic efforts.

The refinery is AMLO government’s attempt to reverse this trend.

Integration with North America is developing around natural gas in the form of LNG, which is why this fuel plays such a big role in cross-border trade. Yet even as technology diversifies, nuclear and coal-based power, like renewables, will only play a complementary, if not marginal role in the overall future scenario for power generation.

Mexican energy sector also faces fundamental and geopolitical factors in the international context:

1) political instability in the Middle East;

2) volatility of production in Nigeria;

3) rising demand from China and India;

4) low surplus production capacity in OPEC countries, with only a small potential margin to be expected in Saudi Arabia, Kuwait and the United Arab Emirates;

5) uncertainty about production in non-OPEC countries, given that most of them have passed their peak outputs so that production is likely to decrease in the future;

6) the need for investment funds;

7) the problem of energy security in the United States, which benefited from the Mexican

government earmarking higher levels of its own oil production for export to there.

GASOLINE AND DIESEL SUBSIDY ERODING PEMEX GAINS

Previously, analysts have said the refinery would be a loss-making venture for Pemex. Pemex refineries struggle to meet demand, with utilization rates of around 40%. The national oil company’s downstream unit has also been consistently unprofitable.

Evidence suggests that in the case of Mexico, policies are frequently more important than Pemex itself when it comes to shielding the country’s consumers from a global energy crisis.

The gasoline and diesel subsidy, whose value is likely to erase the company’s gains from crude exports.

Energy investors may regard this as a missed opportunity, but for millions of drivers, who have seen prices at the pump increase but not to the levels registered in other markets, it is of enormous help.

RECOVERING LOST PRODUCTION IS GREAT BUSINESS STRATEGY. BALANCED, INFORMED INSIGHTS IS A MUST TO SEE THIS SUCCEED.

200,000 b/d more and $2 billion for Zama, pan-American supply chain at risk PEMEX needs to raise production by 200,000-400,000 b/d before 2023 to meet Mexico’s energy security needs.

Instead, production has declined by 600,000 b/d since 2016, the company needs $2 billion in capital to develop the Zama megafield, and more advanced technology is required to move into deepwater.

If production fails to rebound in time:

- Mexico will not have the 800,000 b/d of gasoline and 500,000-600,000 b/d of diesel that it needs to shield itself from crude prices going as high as $380 per barrel, and

- PEMEX will be at risk of defaulting on $3.8 billion in debt payments by December 2022.

Because Mexico is the largest goods manufacturer and exporter in Latin America, the entire pan-American supply chain is at stake.

Production Optimization Americas 2022 (POA) is the only forum that brings together senior management, the subsurface team, and oil industry economists to find technical and management solutions that work for you to:

- Map out the right production stimulation and digitalization solutions for PEMEX to fully utilize their new Olmeca (Dos Bocas) and Deer Park refineries

- Find a way for private partners to provide capital for field development and deliverability without new auctions or farm-outs, and

- Identify the best partners for PEMEX and other NOCs in the Western Hemisphere to collaborate with and avoid what could become an even bigger oil shock than 1973.

Attend Production Optimization Americas 2022 (POA) on 20-21 October 2022 in Mexico City.

Sizzling Valuations No Bar for Deals as AI Boom Beckons

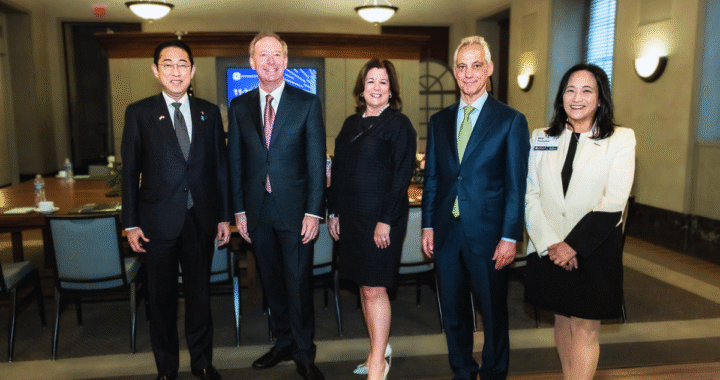

Sizzling Valuations No Bar for Deals as AI Boom Beckons  Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure

Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure  Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia

Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia  Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse

Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse