The Dynamics Shaping Success in Key Asia-Pacific Data Center Markets

The Asia-Pacific data center market is entering a period of sustained growth, fueled by surging demand for cloud services, artificial intelligence applications, and stricter data sovereignty rules.

Southeast Asia alone attracted $10.23 billion in data center investments in 2023. Analysts at Global Data Insights forecast that figure will climb to $17.73 billion by 2029, a compound annual growth rate of 9.6 percent. During the same period, spending on new construction is expected to advance at an 11.2 percent CAGR, reaching $5.29 billion by 2029.

The region’s digital economy is expanding rapidly. Internet penetration has surged, and monthly data usage in South and Southeast Asia is projected to rise from 9.2 gigabytes per user in 2020 to 28.9 gigabytes by 2025. Growth in streaming, online gaming, and e-commerce is creating immediate pressure for more capacity. Governments have responded with major infrastructure projects, such as Malaysia’s JENDELA broadband initiative, that aim to strengthen backhaul networks and make new sites viable for hyperscale operators.

Regulatory Drivers and Market Leaders

At the same time, data localization rules in markets such as Malaysia and Vietnam have compelled global cloud providers to build or lease local capacity. The region’s leading operators, among them ST Telemedia Global Data Centres and Singtel, now manage hundreds of megawatts of IT load, often in partnership with hyperscalers. Thai conglomerate Gulf Energy Development has committed $271 million to double the capacity of its Bangkok campus to 50 megawatts and has struck a deal with Google to accelerate its cloud services rollout.

Global giants are stepping up investments as well. Amazon Web Services plans to boost its Singapore capital-expenditure budget to S$23.5 billion by 2028, while AWS has also pledged $6 billion to Malaysia and $5 billion each to Indonesia and Thailand over the next 15 years. Microsoft, for its part, has earmarked $1.7 billion for Indonesia and $2.2 billion for Malaysia in support of cloud and AI-focused infrastructure.

Private equity firms see opportunity in the build-out, too. Bain Capital’s $3.2 billion acquisition of Chindata Group will add capacity across India and Southeast Asia. KKR has taken an $800 million stake in Singtel’s data center unit, and PGIM intends to deploy up to $3 billion in the next two years.

Bottlenecks, Edge Computing, and the Road Ahead

Even as investment pours in, operators face bottlenecks. Power and land prices in urban cores can be prohibitive, forcing some projects to secondary markets that lack fiber and reliable electricity. A shortage of skilled technicians is compounding the challenge: trade groups estimate the region will fall short by more than 4 million IT staff by 2030. Meanwhile, cooling systems need to be re-engineered to operate efficiently in tropical climates without breaching new carbon emissions limits.

Looking ahead, success in the Asia-Pacific will hinge on three factors: regulatory stability, access to reliable power, and the ability to deliver lower-latency services via edge-computing facilities. Those markets that streamline approvals, offer green energy incentives, and cultivate skilled local talent will likely emerge as the region’s premier hubs. For firms willing to navigate the complexity, the payoff promises to be substantial. As one industry veteran put it, “The data center race in Asia is more than a build-out; it’s about building the foundations of tomorrow’s digital economy.”

Sizzling Valuations No Bar for Deals as AI Boom Beckons

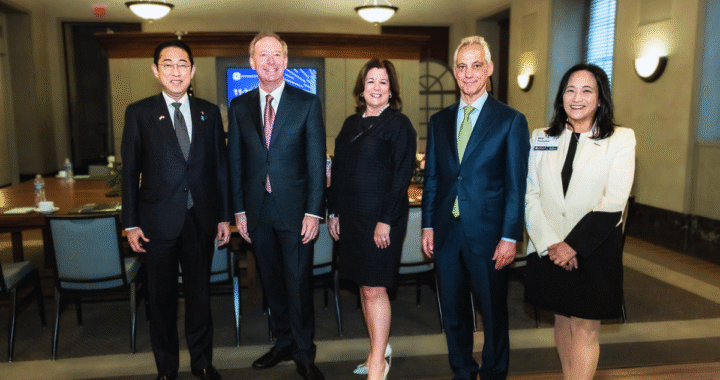

Sizzling Valuations No Bar for Deals as AI Boom Beckons  Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure

Microsoft’s $2.9 Billion Boost to Japan’s AI & Cloud Infrastructure  Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia

Google Awards Gamuda a Second Contract for Their $2 Billion Data Center in Malaysia  Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse

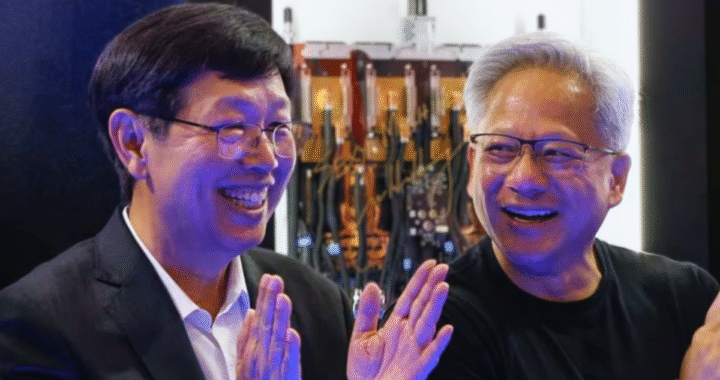

Philippines Poised to Emerge as Southeast Asia’s Data Center Powerhouse  Taiwan’s Foxconn Says AI Data Center with NVIDIA to Have 100 MW of Power

Taiwan’s Foxconn Says AI Data Center with NVIDIA to Have 100 MW of Power  BDx Locks in Financing for Hong Kong Hyperscale Build-Out

BDx Locks in Financing for Hong Kong Hyperscale Build-Out